|

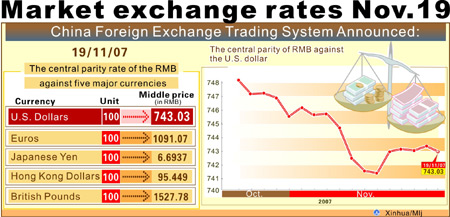

Graphics shows the central parity rate of the Chinese currency, Renminbi (RMB), against five major currencies, announced by the China Foreign Exange Trading System on Nov. 19, 2007. (Xinhua/Meng Lijing)

BEIJING, Nov. 20 -- China may make its exchange rate more flexible and, if necessary, consider widening the yuan's trading band, central bank (or the People's Bank of China) governor Zhou Xiaochuan has said.

But any change in the yuan's floating band will depend on the global economic situation and it's not the only tool the country would use to make its currency more flexible, Zhou was quoted as having said on Sunday.

Attending the Group of 20 (G20) meeting in Cape Town, South Africa, he said: "Actually I think the floating band is quite all right, but if need be we can consider expanding it."

Finance ministers and central bank governors of leading industrialized and emerging economies, too, attended the meeting.

Some Western leaders have been pressuring China to revalue its currency at a faster pace, blaming the exchange rate for global economic imbalance and mounting trade deficits they suffer from.

But China has adopted a gradual approach to the yuan's adjustment. In fact, many economists have warned the country's economy would suffer irreparable damage if the yuan is revalued at a faster pace, and have cited the example of Japan in the 1980s to illustrate their point.

The value of the Japanese yen tripled against the dollar during 1985-95, its highest in history, and it caused "terrible" damage to Japan's economy, Nobel Economics Laureate Robert Mundell said.

"That's something to be worried about and (should be) avoided," the Columbia University economics professor told China Daily in an earlier interview.

China widened the yuan's daily trading band against the US dollar from plus or minus 0.3 percent to 0.5 percent in May. The yuan's central parity rate was 7.43 against 1 dollar Monday, up about 9 percent since being de-pegged from the greenback on July 21, 2005.

(Source: China Daily)